Losing a job or managing a limited budget can make healthcare costs feel overwhelming. With traditional insurance, high premiums and steep deductibles leave many searching for more affordable alternatives. This is where HealthShares can make a difference. These community-based cost sharing programs offer a unique, more affordable way to manage healthcare expenses, providing support without the high costs of traditional health insurance plans.

In this article, we will explore how HealthShares work, why they can be a smart option, and how they fit into an overall strategy for securing healthcare on a budget. Whether you have recently faced a career setback or are working to make every dollar count, understanding this alternative approach could be the key to accessing affordable care when you need it.

How Does the Cost of Healthcare Affect Overall Health?

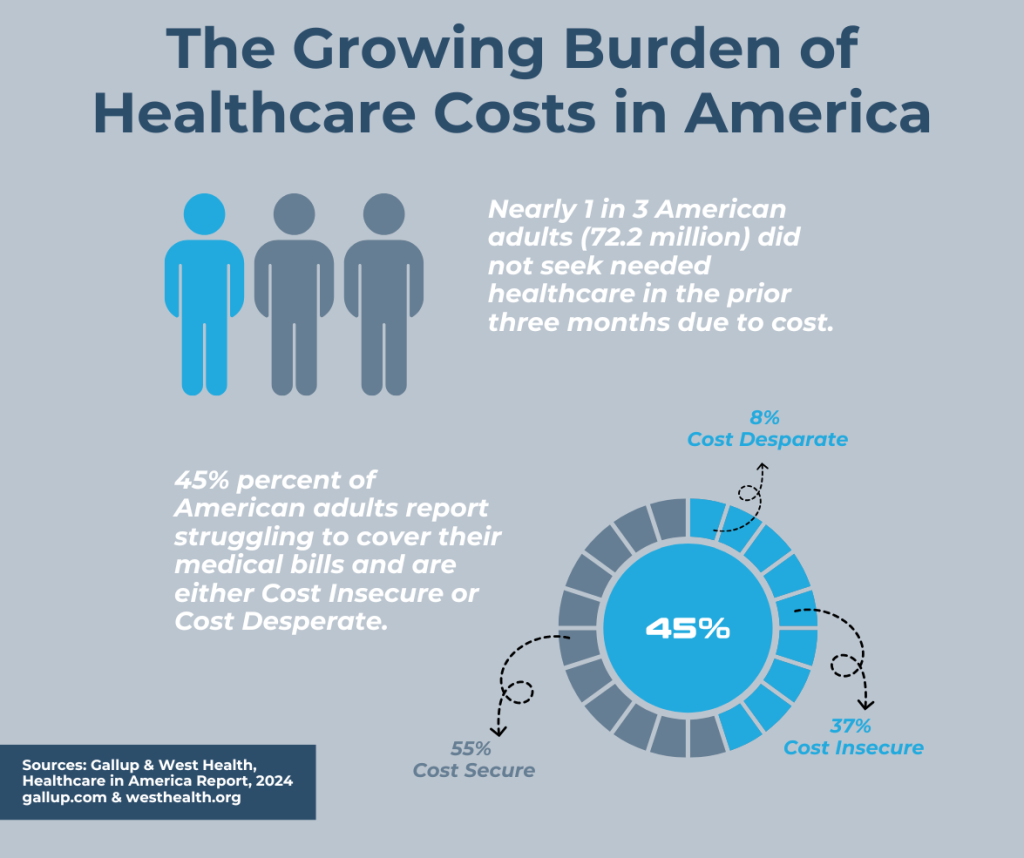

The high cost of healthcare does not just impact your bank account — it can also put your health at risk. According to a West Health press release and the Gallup & West Health Healthcare in America report, studies show that more Americans than ever are struggling to afford medical expenses, with many avoiding care entirely due to cost.

Putting off care due to cost can have serious consequences. Minor health concerns that go unchecked can develop into chronic conditions or turn into larger, more expensive problems. Preventive care, routine check-ups, and early intervention play a vital role in catching potential problems before they become escalated. This avoidance affects more than physical health — the stress of untreated symptoms and financial strain can also take a toll on mental well-being, creating a harmful cycle.

Traditional Healthcare Choices After a Job Loss

For individuals and families experiencing a life event, such as job loss, finding affordable healthcare often means considering multiple options. There are several programs and plans designed to help, each with their own strengths and challenges. Here’s a look at some traditional healthcare options available and how they may work for a job loss:

- COBRA Coverage: This option allows employees and their dependents to temporarily continue their employer-sponsored health insurance after job loss, reduced work hours, or other qualifying events. However, it requires individuals to pay the full premium—including both their share and the portion previously paid by the employer—plus a small administrative fee, often making it an expensive choice. This type of coverage usually lasts 18 months but may extend to 36 months in some cases.

- Marketplace Insurance: This refers to health insurance plans available through the Health Insurance Marketplace, which allows individuals and families without employer-sponsored coverage, Medicaid, or Medicare to compare and purchase health insurance. Subsidies may be available to lower costs, but without financial assistance, premiums can be expensive. Even with subsidies, out-of-pocket expenses like deductibles, copays, and coinsurance can add up, making healthcare costly for those who need frequent medical care.

- Medicaid & CHIP: These government programs provide comprehensive, low-cost (or free) coverage to eligible individuals and families. However, each state administers its own Medicaid and Children’s Health Insurance Program (CHIP) programs within federal guidelines, meaning eligibility requirements and benefits can vary. Some states have expanded Medicaid to cover more low-income adults, while others have stricter rules, often limiting coverage to children, pregnant women, and people with disabilities. As a result, not everyone qualifies, and those that do may experience gaps in coverage.

- Short-Term Insurance: Short-term plans offer temporary coverage with lower premiums, making them an option for individuals experiencing gaps in insurance, such as a job loss. Typically lasting a few months to under a year, they do not have to comply with the Affordable Care Act (ACA), meaning they often exclude essential benefits like preventive care, maternity services, and mental health treatment. While they may be more affordable, they tend to have high deductibles and limited benefits, leaving policyholders responsible for significant medical costs. Since they are not required to cover pre-existing conditions, individuals with ongoing health concerns may struggle to find adequate coverage.

Traditional Healthcare Choices for Low-Income Households

For low-income individuals and families, accessing affordable healthcare often requires exploring a range of options. In these situations, several potential solutions exist, each with their own strengths and challenges. Here’s an overview of traditional healthcare options and how they may work for low-income households:

- Medicaid & CHIP: Medicaid and the Children’s Health Insurance Program (CHIP) are two of the most common options for low-income individuals and families. Medicaid eligibility is based on income, household size, and other factors, with each state setting its own rules within federal guidelines. While Medicaid expansion has increased access in many states, others have stricter eligibility requirements, which means some low-income adults may not qualify, even if they cannot afford private insurance. CHIP focuses primarily on providing coverage for children in working families who earn too much to qualify for Medicaid but still need affordable healthcare.

- Marketplace Insurance: The Health Insurance Marketplace offers options for households that earn too much to qualify for Medicaid but still need assistance. Based on income, individuals and families may qualify for premium tax credits or reductions to help lower monthly premiums and out-of-pocket costs. While these subsidies can help, plans may still be difficult to afford for those managing a tight budget, especially when high deductibles, copays, and coinsurance make ongoing care harder to access.

- Community Health Centers & Local Programs: Community health centers, free clinics, and local assistance programs often provide healthcare on a sliding fee scale, making them a potential option for low-income households. These centers typically offer essential services like primary care, preventive screenings, and basic women’s and pediatric care—though access to specialized treatments may be limited. While these programs play a critical role in serving low-income populations, they are often underfunded and may have long wait times or limited availability.

- Short-Term Insurance: Short-term health plans are sometimes considered by low-income individuals who do not qualify for Medicaid and find Marketplace coverage too expensive. These plans tend to have lower monthly premiums, but they come with significant limitations, including high deductibles, restricted benefits, and exclusions for pre-existing conditions. For households with minimal healthcare needs, they can provide a temporary option, but they do not offer comprehensive coverage or long-term security.

How HealthShares Can Help

HealthShares offer a different approach, providing a practical and budget-friendly alternative for those looking to manage medical expenses outside of traditional insurance. They are community-based organizations where like-minded members contribute a set monthly amount to help share each other’s eligible medical expenses.

Whether following a job loss or having a limited income, HealthShares often have significantly lower monthly costs, making them a more affordable choice compared to COBRA or Marketplace plans. Unlike Medicaid and CHIP, HealthShares are not income-based, meaning anyone can qualify regardless of their financial situation. This can be especially valuable for those who earn too much to qualify for Medicaid but cannot afford a traditional insurance plan, even with subsidies. Additionally, while short-term insurance often excludes pre-existing conditions and essential health benefits, several HealthShares not only include major medical services like hospitalizations and emergency care, but also may share in costs for certain preventive care, maternity services, eligible prescriptions, telemedicine, pre-existing conditions, and more — though waiting periods or limitations may apply.

Another advantage is that HealthShares offer a flexible enrollment process, allowing individuals to join at any time — without open enrollment periods or the need to meet a qualifying life event, such as job loss. This flexibility allows HealthShares to serve as a supportive option when employer-sponsored coverage suddenly ends, offering protection against major medical expenses during times of transition. Traditional insurance, on the other hand, limits enrollment to specific periods each year (with exceptions for qualifying life events). Because HealthShares accept new members year-round, they can provide timely access to care — regardless of income or recent life changes. However, some HealthShares may apply waiting periods or other limitations for certain services. In addition, HealthShares can serve as either a short-term solution during coverage gaps or a long-term alternative to traditional insurance, giving members flexibility to choose the option that works best for them, even if their income fluctuates over time.

*Note that HealthShares are not insurance, and some programs or services may have limitations, waiting periods, or exclusions for certain types of care based on their member guidelines. Taking the time to carefully review guideline details can help ensure that the HealthShare program aligns with individual or family healthcare needs and preferences. For many, HealthShares offer a cost-effective, flexible, and sustainable way to manage medical expenses, providing ongoing support without the high costs of traditional insurance.

Final Considerations: Putting Your Health First

Choosing how to manage healthcare costs during a period of job loss or financial uncertainty can feel overwhelming. Whether exploring HealthShares or more traditional options, it’s important to fully understand how each program works, what’s included, and weigh the pros and cons of each.

Taking time to review all available options isn’t just about managing costs — it also helps ensure access to essential care and promotes better health. Maintaining good health is key, and choosing an option that supports overall well-being is an important part of that process.

There is not a one-size-fits-all solution, but understanding the options and asking the right questions can help lead to informed decisions that support both health and finances.