With more families and individuals seeking alternatives to traditional insurance, and with so many HealthShare plans available, how do you know which one is right for you? The HealthShare industry is evolving faster than ever, so we’ve done some homework to highlight the top 10 plans worth considering. From innovative strategies to trusted solutions, these plans stand out in affordability, flexibility, and their ability to meet diverse healthcare needs.

What Are HealthShares, and Why Consider Them?

HealthShares are non-profit organizations where members contribute monthly to a shared fund, which is used to help share in each other’s medical expenses. Eligible costs are determined based on the specific membership guidelines of each HealthShare. Unlike traditional insurance, HealthShares foster a sense of community, prioritize transparency, and provide affordable, flexible solutions, making them an appealing choice for individuals, couples, families, seniors, and businesses.

Here are the 10 best HealthShare plans in 2025, highlighting what makes them unique and why they earned a spot on this list:

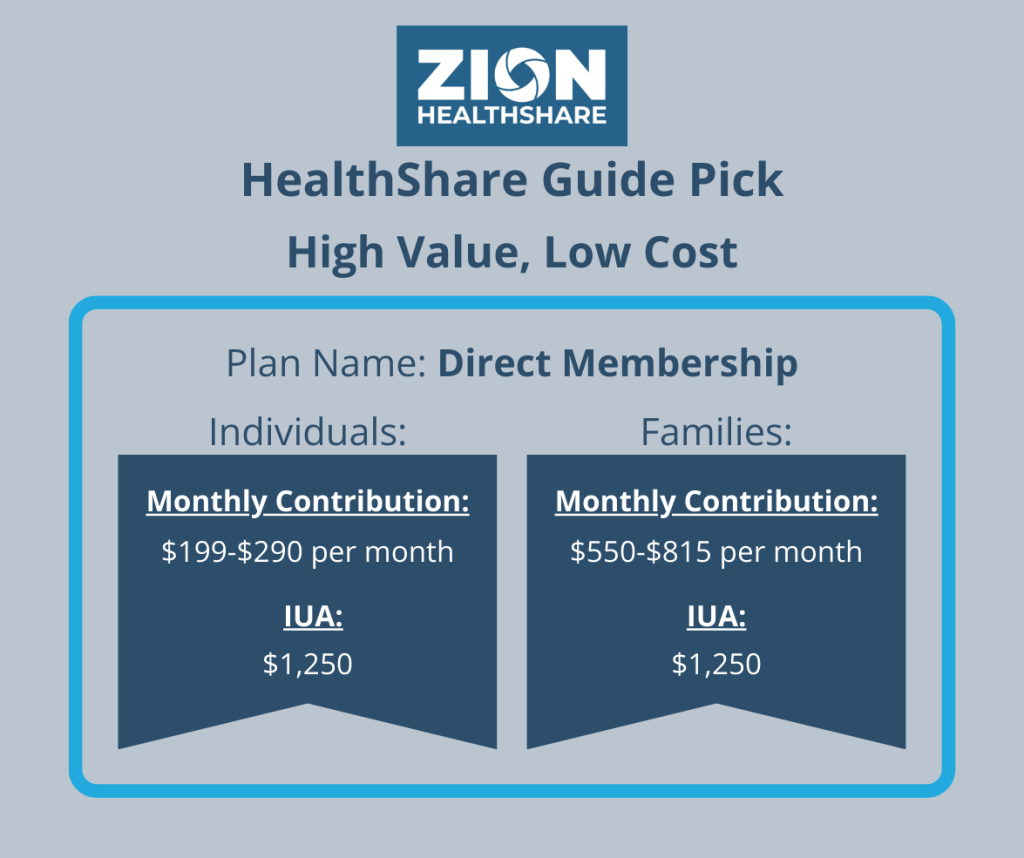

Zion HealthShare

Plan Summaries:

NOTE:

- The amount of the member’s monthly contribution depends on their age group, chosen Initial Unshareable Amount (IUA), and household size.

- Direct memberships are for those who sign up through Zion HealthShare’s website.

- Essential memberships are for those who sign up through their employer or who pair their membership with a Direct Primary Care (DPC) provider.

Direct Membership – includes major medical, preventive, telemedicine, maternity, therapeutic services, and prescription discounts.

Individuals – $111-$305 per month

Couples – $199-$588 per month

Member and Child(ren) – $199-$588 per month

Family – $324-$856 per month

Initial Unshareable Amount (IUA) Options – $1,250, $2,500, or $5,000

Additional Option – Mental health can be added for a small fee ($5-$20 per month) depending on the size of the member’s household.

Essential Membership – includes major medical.

Individuals – $82-$284 per month

Couples – $160-$515 per month

Member and Child(ren) – $160-$515 per month

Family – $268-$740 per month

Initial Unshareable Amount (IUA) Options – $1,250, $2,500, or $5,000

Additional Options – Preventive care, prescription discounts, telemedicine, and mental health can be added for a small fee ($5-$60 per month) depending on the size of the member’s household.

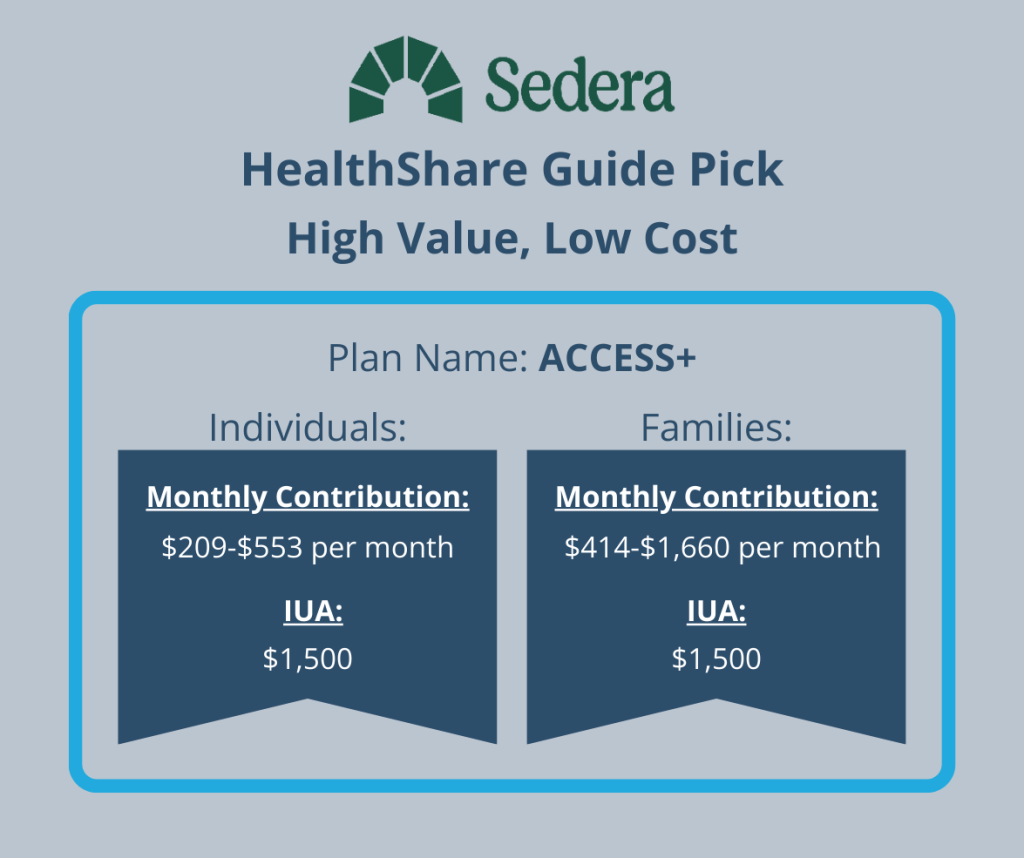

Sedera

Plan Summaries:

NOTE:

- The amount of the member’s monthly contribution depends on their age group, chosen Initial Unshareable Amount (IUA), and household size.

- ACCESS+ is for individuals and families, having five IUA levels, and five age groups (ranging from 18 to 64 years old).

- SELECT+ is for businesses/teams, having five IUA levels, and two age groups (under 30 and 30+).

ACCESS+ – includes major medical, telemedicine, and expert second opinion services.

Individuals – $141-$687 per month

Couples – $246-$1,337 per month

Member and Child(ren) – $240-$1,267 per month

Family – $350-$1,933 per month

Initial Unshareable Amount (IUA) Options – $500, $1,000, $1,500, $2,500, or $5,000

Direct Primary Care (DPC) Option – Members can choose to add DPC to any membership. Prices for these memberships differ slightly from the ones listed above. Click here for ACCESS+ with DPC prices.

SELECT+ – includes major medical, telemedicine, and expert second opinion services.

Individuals – $141-$687 per month

Couples – $246-$1,337 per month

Member and Child(ren) – $240-$1,267 per month

Family – $350-$1,933 per month

Initial Unshareable Amount (IUA) Options – $500, $1,000, $1,500, $2,500, or $5,000

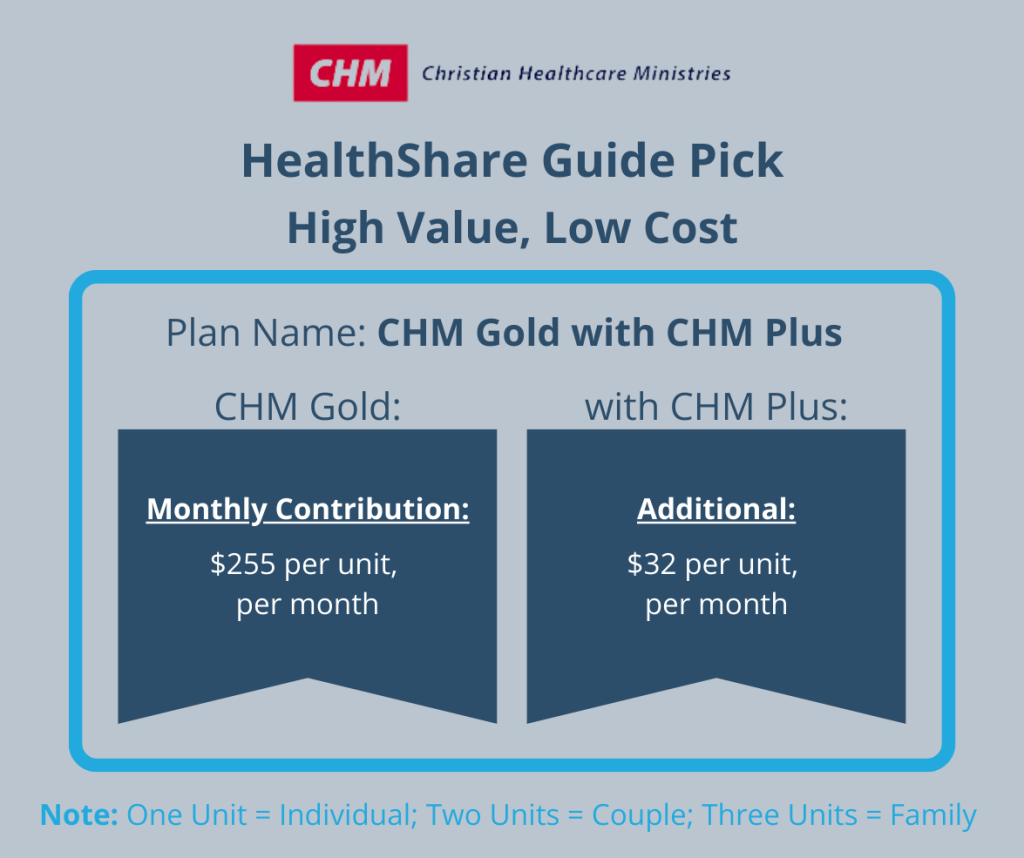

Christian Healthcare Ministries (CHM)

Plan Summaries:

NOTE:

- Members are responsible for a Personal Responsibility (PR) amount and must reach a minimum Qualifying Amount (QA) before sharing begins.

- CHM utilizes a unit system; a unit refers to each participating individual within a membership. Example: Individual = One unit, Couple = Two units, Family = Three units, regardless of the number of dependent children.

CHM Bronze – includes major medical, telemedicine, and maternity.

$98 per unit, per month

Personal Responsibility (PR) – $6,000 per unit

Qualifying Amount (QA) – Totaling $6,000 per unit, up to $125,000 per illness/incident

Additional Option – CHM Plus for an additional fee of $32 per unit, per month which shares and additional $100,000 in expenses exceeding $125,000 per illness/incident, up to $1 million.

CHM Silver – includes major medical, telemedicine, and maternity.

$148 per unit, per month

Personal Responsibility (PR) – $3,000 per unit

Qualifying Amount (QA) – Totaling $3,000 per unit, up to $125,000 per illness/incident

Additional Option – CHM Plus for an additional fee of $32 per unit, per month which shares an additional $100,000 in expenses exceeding $125,000 per illness/incident, up to $1 million.

CHM Gold – includes major medical, telemedicine, maternity, physical therapy, home healthcare, incident-related office visits, and prescriptions.

$255 per unit, per month

Personal Responsibility (PR) – $1,250 per unit

Qualifying Amount (QA) – Totaling $1,250+ per unit, up to $125,000 per illness/incident

Additional Option – CHM Plus for an additional fee of $32 per unit, per month which shares in expenses exceeding $125,000 per illness/incident and becomes unlimited.

CHM SeniorShare – includes major medical, telemedicine, physical therapy, home healthcare, and incident-related office visits and prescriptions.

*Members must have Medicare Parts A and B to be eligible for this plan.

$115 per unit, per month

Personal Responsibility (PR) – $0

Qualifying Amount (QA) – Totaling $500, up to $125,000 per illness/incident

Additional Option – CHM Plus for an additional fee of $27 per unit, per month which shares in expenses exceeding $125,000 per illness/incident and becomes unlimited.

Medi-Share

Plan Summaries:

NOTE:

- The amount of the member’s monthly contribution depends on their age group, chosen Annual Household Portion (AHP), and household size.

- Some plans have a co-share option of 30% in addition to the AHP.

- There is a $52 start-up fee.

Medi-Share Complete $3K, $6K, $9K, $12K – includes major medical, annual wellness visit, telemedicine, and maternity.

AHP $3,000:

Individuals – $246-$393 per month

Couples/Family – $610-$1,015 per month

Annual Household Portion (AHP) – $3,000

- With Co-Share Amount Option – $3,000 AHP plus 30% co-share up to $7,000 = $10,000 max responsibility for the member

AHP $6,000:

Individuals – $188-$329 per month

Couples/Family – $452-$839 per month

Annual Household Portion (AHP) – $6,000

- With Co-Share Amount Option – $6,000 AHP plus 30% co-share up to $4,000 = $10,000 max responsibility for the member

AHP $9,000:

Individuals – $154-$266 per month

Couples/Family – $358-$665 per month

Annual Household Portion (AHP) – $9,000

- With Co-Share Amount Option – $9,000 AHP plus 30% co-share up to $3,000 = $12,000 max responsibility for the member

AHP $12,000:

Individuals – $115-$198 per month

Couples/Family – $250-$479 per month

Annual Household Portion (AHP) – $12,000

- With Direct Primary Care Option – $12,000 AHP minus DPC fees up to $1,800 = $10,200 max responsibility for the member

Samaritan Ministries

Plan Summaries:

NOTE:

- The amount of the member’s monthly contribution depends on the chosen membership level, age of the oldest member, and household size.

- A two-person membership, or its equivalent, is required for maternity needs, with separate limitations and sharing percentages.

Samaritan Basic – includes major medical, maternity, and prescription discounts.

Individuals – $115-$193 per month

Couples – $228-$368 per month

Member and Child(ren) – $228-$455 per month

Family – $305-$455 per month

Initial Unshareable Amount – $1,500

Sharing Percentage – shared at 90% with a10% member responsibility up to $2,500; up to $13,500 for maternity

Maximum Sharing Limit – $247,500 per incident; $5,000 maternity limit

Save-to-Share Option – an additional annual fee of $15 for participating households which will set aside funds each month to be used in helping with costs that exceed the plan’s maximum sharing limit.

- Individuals – $133 set aside amount

- Couples/Single-parent family – $266 set aside amount

- Family (three or more) – $399 set aside amount

Samaritan Classic – includes major medical, maternity, and prescription discounts.

Individuals – $192-$348 per month

Couples – $591-$681 per month

Member and Child(ren) – $507 per month (all age ranges and household sizes)

Family – $665-$821 per month

Initial Unshareable Amount – $750

Sharing Percentage – shared at 100%

Maximum Sharing Limit – $250,000 per incident; $247,000 maternity limit

Save-to-Share Option – an additional annual fee of $15 for participating households which will set aside funds each month to be used in helping with costs that exceed $250,000.

- Individuals – $133 set aside amount

- Couples/Single-parent family – $266 set aside amount

- Family (three or more) – $399 set aside amount

Liberty HealthShare

Plan Summaries:

NOTE:

- The amount of the member’s monthly contribution depends on their age group, chosen Annual Unshared Amount (AUA), plan type, and household size.

- Some plans require a 15% or 25% co-share amount in addition to the AUA and sharing limits differ depending on specific types of services.

- There is a $135 start-up fee and a $75 annual renewal fee.

Liberty Freedom – includes major medical only for 35 years of age or younger.

Individuals – $89 per month

Couples – $169 per month

Family – $319 per month

Annual Unshared Amount (AUA) – Single $10,000, Couple $15,000, Family $20,000

Maximum Sharing Limit – $300,000 per incident

No additional options available with Liberty Freedom

Liberty Essential – includes major medical, preventive, telemedicine, home healthcare, ancillary care, and maternity.

Individuals – $163-$225 per month

Couples – $266-$390 per month

Family – $513-$750 per month

Annual Unshared Amount (AUA) – Single $4,000, Couple $8,000, Family $12,000

Maximum Sharing Limit – $600,000 per incident

Co-Share Amount – 25% member responsibility

Additional Options – dental, vision, LASIK, and prescription discounts

Liberty Connect – includes major medical, preventive, telemedicine, home healthcare, ancillary care, and maternity.

Individuals – $215-$287 per month

Couples – $349-$503 per month

Family – $658-$967 per month

Annual Unshared Amount (AUA) – Single $1,000, Couple $2,000, Family $3,000

Maximum Sharing Limit – $1 million per incident

Co-Share Amount – 15% member responsibility

Additional Options – dental, vision, LASIK, and prescription discounts

Liberty Unite – includes major medical, preventive, telemedicine, home healthcare, ancillary care, and maternity.

Individuals – $266-$369 per month

Couples – $472-$668 per month

Family – $874-$1,276 per month

Annual Unshared Amount (AUA) – Single $1,000, Couple $1,750, Family $2,250

Maximum Sharing Limit – $1 million per incident

Co-Share Amount – shared at 100%

Additional Options – dental, vision, LASIK, and prescription discounts

Liberty Rise – includes major medical, telemedicine, CT and MRI scans, primary care and specialist office visits, for young single adults and married* couples, ages 18-29 without children.

*If married: each person must have their own membership.

Individuals/Couples – $99 per month

Unshared Amount Per Visit – $25-$500 depending on specific service type

Maximum Sharing Limit – $500-$1,250 per year depending on service type; $1,250 per day for surgeon fee

Additional Options – dental, vision, LASIK, and prescription discounts

Liberty Assist – fills the gaps in medical expenses.

*Members must be enrolled in Medicare Parts A and B.

*If married: each person must have their own membership.

Individuals/Couples – $87-$281 per month depending on age group

Annual Unshared Amount (AUA) – $500

Maximum Sharing Limit – $500-$1,250 per year depending on service type; $1,250 per day for surgeon fee

Additional Options – dental, vision, LASIK, and prescription discounts

Impact Health Sharing

Plan Summaries:

NOTE:

- The amount of the member’s monthly contribution depends on their age group, chosen Primary Responsibility Amount (PRA), and household size.

- Members have a co-share amount of 10% in addition to the AHP (Senior plans excluded).

- There is a $79 start-up fee.

Impact Individuals and Families – includes major medical, preventive, maternity, and mental health.

$2,500 PRA:

Individuals – $196-$426 per month

Couples – $398-$697 per month

Family – $550-$812 per month

Primary Responsibility Amount (PRA) – $2,500

Co-Share Amount – 10% per household, per year

Maximum Annual Sharing Limit – $500,000

Additional Options – dental, vision, health & wholeness credit, labs, prescriptions, and telemedicine.

$5,000 PRA:

Individuals – $153-$380 per month

Couples – $352-$640 per month

Family – $493-$755 per month

Primary Responsibility Amount (PRA) – $5,000

Co-Share Amount – 10% per household, per year

Maximum Annual Sharing Limit – $500,000

Additional Options – dental, vision, health & wholeness credit, labs, prescriptions, and telemedicine.

$7,500 PRA:

Individuals – $119-$334 per month

Couples – $306-$582 per month

Family – $435-$697 per month

Primary Responsibility Amount (PRA) – $7,500

Co-Share Amount – 10% per household, per year

Maximum Annual Sharing Limit – $500,000

Additional Options – dental, vision, health & wholeness credit, labs, prescriptions, and telemedicine.

$10,000 PRA:

Individuals – $73-$288 per month

Couples – $260-$525 per month

Family – $378-$640 per month

Primary Responsibility Amount (PRA) – $10,000

Co-Share Amount – 10% per household, per year

Maximum Annual Sharing Limit – $500,000

Additional Options – dental, vision, health & wholeness credit, labs, prescriptions, and telemedicine.

Impact for Seniors – includes major medical, preventive, and mental health.

*Members must be enrolled in Medicare Parts A and B.

Individuals Only – $96 per month

Primary Responsibility Amount (PRA) – $1,000

Maximum Annual Sharing Limit – $500,000

Additional Options – dental, vision, health & wholeness credit, labs, prescriptions, and telehealt

United Refuah HealthShare

Plan Summaries:

NOTE:

- Plans are based on family size (single, couple, and family with 3-6 members.

- Annual Pre-Share Amount (APA) and Co-Share maximums apply.

- Additional Pregnancy Pre-Share amounts apply for couples or single memberships (must be married at time of conception).

- $125 start-up fee and a $75 annual renewal fee.

United Refuah Single, Couple, Family – includes major medical, annual wellness visit, telemedicine, maternity, and prescription discounts.

Single:

$199 per month

Annual Pre-Share Amount (APA) – $500

Co-Share Amount – 20% co-share up to $1,000 per year

Maximum Sharing Limit – $1 million per incident

Couple:

$349 per month

Annual Pre-Share Amount (APA) – $1,000

Co-Share Amount – 20% co-share up to $2,000 per year

Maximum Sharing Limit – $1 million per incident

Family (3-6 members):

$499 per month ($50 for each additional family member over 6 members)

Annual Pre-Share Amount (APA) – $1,500

Co-Share Amount – 20% co-share up to $4,000 per year

Maximum Sharing Limit – $1 million per incident

OneShare Health

Plan Summaries:

NOTE:

- The amount of the member’s monthly contribution depends on their age group, chosen Individual Sharing Amount (ISA), plan level, and household size.

- Services may vary by state.

- $125 start-up fee and a $45 renewal fee.

OneShare Catastrophic – includes major medical, telemedicine, online mental health, and various discounts on services like vision, dental and prescriptions.

Individuals – $59-$446 per month

Couples – $190-$684 per month

Family – $155-$882 per month

Individual Sharing Amount (ISA) – $5,000-$10,000

Maximum Sharing Limit – $150,000-$500,000 per incident

Maximum Lifetime Sharing Limit – $300,000-$1 million

OneShare Classic Basic – includes major medical, telemedicine, preventive, maternity, online mental health, and various discounts on services like vision, dental and prescriptions.

Individuals – $100-$353 per month

Couples – $108-$807 per month

Family – $282-$977 per month

Individual Sharing Amount (ISA) – $5,000-$10,000

Maximum Sharing Limit – $150,000 per incident

Maximum Lifetime Sharing Limit – $1 million

OneShare Classic Enhanced – includes major medical, telemedicine, preventive, maternity, online mental health, and various discounts on services like vision, dental and prescriptions.

Individuals – $139-$432 per month

Couples – $224-$862 per month

Family – $323-$1,132 per month

Individual Sharing Amount (ISA) – $5,000-$10,000

Maximum Sharing Limit – $250,000 per incident

Maximum Lifetime Sharing Limit – $1 million

OneShare Classic Crown – includes major medical, telemedicine, preventive, maternity, online mental health, and various discounts on services like vision, dental and prescriptions.

Individuals – $173-$571 per month

Couples – $239-$902 per month

Family – $350-$1,355 per month

Individual Sharing Amount (ISA) – $5,000-$10,000

Maximum Sharing Limit – $500,000 per incident

Maximum Lifetime Sharing Limit – $1 million

Altrua HealthShare

Plan Summaries:

NOTE:

- The amount of the member’s monthly contribution depends on their age group, plan type, and household size.

- 1st MRA = members pay this amount before sharing begins. 2nd MRA = 25% of eligible expenses after 1st MRA is met up to $2,500.

- There is a $25 start-up fee and a $100 renewal fee.

Ruby – includes major medical, telemedicine, 6 pooled office visits per member, counseling, and cancer treatments.

Individuals – $136 per month

Couples – $200 per month

Family – $265 per month

1st Member Responsibility Amount (MRA) – $7,500 per person, per year

2nd Member Responsibility Amount (MRA) – N/A

Maximum Annual Sharing Limit – $150,000

Maximum Lifetime Sharing Limit – $1 million

Additional Options – prescription, ChooseHealthy program, labs, vision, LASIK, and hearing

Sapphire – includes major medical, telemedicine, 6 pooled office visits per member, counseling, and cancer treatments.

Individuals – $173-$424 per month

Couples – $345-$769 per month

Family – $468-$849 per month

1st Member Responsibility Amount (MRA) – $1,500 per person, per year

2nd Member Responsibility Amount (MRA) – 25% up to $2,500

Maximum Annual Sharing Limit – $250,000

Maximum Lifetime Sharing Limit – $1 million

Additional Options – prescription, ChooseHealthy program, labs, vision, LASIK, and hearing

Emerald – includes major medical, telemedicine, 6 pooled office visits per member, maternity, adoption, labs, counseling, and cancer treatments.

Individuals – $318-$528 per month

Couples – $496-$967 per month

Family – $661-$1,056 per month

1st Member Responsibility Amount (MRA) – $1,000 per person, per year

2nd Member Responsibility Amount (MRA) – 25% up to $2,500

Maximum Annual Sharing Limit – None

Maximum Lifetime Sharing Limit – $1 million

Additional Options – prescription, ChooseHealthy program, labs, vision, LASIK, and hearing

Diamond – includes major medical, telemedicine, 6 pooled office visits per member, maternity, adoption, labs, counseling, and cancer treatments.

Individuals – $356-$617 per month

Couples – $528-$1,075 per month

Family – $706-$1,145 per month

1st Member Responsibility Amount (MRA) – $500 per person, per year

2nd Member Responsibility Amount (MRA) – 25% up to $2,500

Maximum Annual Sharing Limit – None

Maximum Lifetime Sharing Limit – $2 million

Additional Options – prescription, ChooseHealthy program, labs, vision, LASIK, and hearing

Choosing the right HealthShare plan comes down to understanding your unique healthcare needs and priorities. Whether you value affordability, flexibility, comprehensive sharing, or specialized support, these 10 best HealthShare plans in 2025 provide a variety of options to suit individuals, families, seniors, and businesses alike.

As the HealthShare industry continues to evolve, it offers a refreshing alternative to traditional insurance, focusing on community, transparency, and shared responsibility. By exploring these plans, you can find a solution that not only fits your budget but also aligns with your values and lifestyle. Take the time to compare, ask questions, and make an informed decision—because your healthcare choice should bring you confidence, peace of mind, and the support you deserve.