What if belonging to a HealthShare could offer simplicity, transparency, a sense of belonging, and financial peace of mind? For many, HealthShares have become exactly that—combining those strengths without sacrificing quality care. As traditional health insurance becomes more complex, individuals, families, and businesses are turning to HealthShares as a practical, sustainable solution.

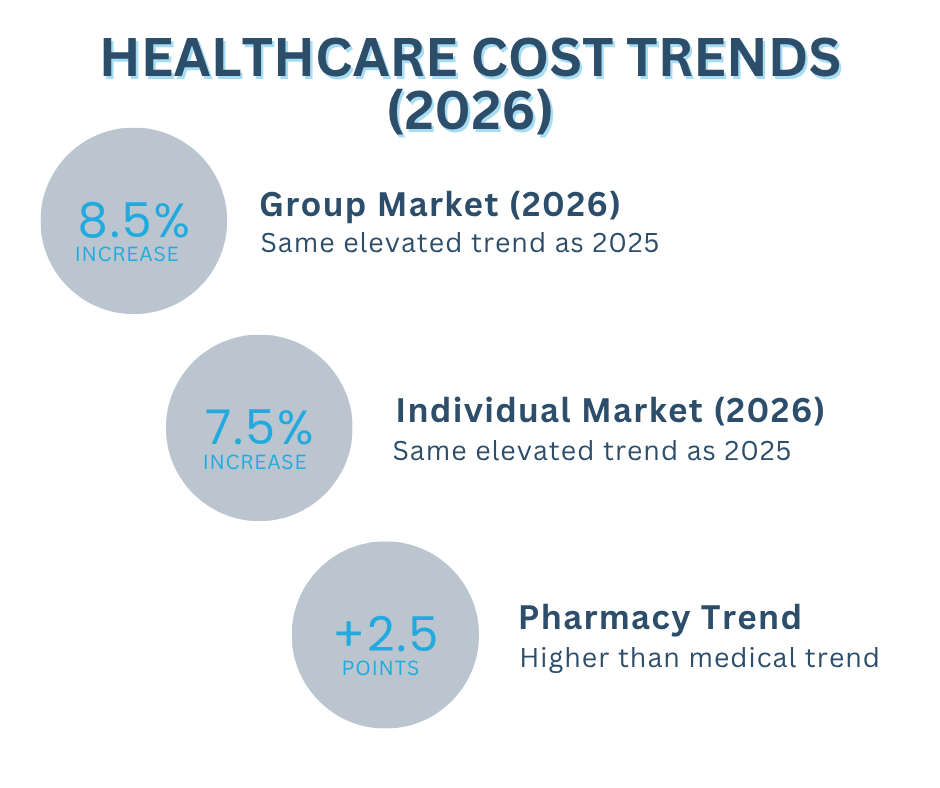

What These Trends Mean for HealthShares

As we head into 2026, HealthShares address these healthcare trends with lower-cost strategies, personalized program options, and a member-centered experience. Together, these approaches provide a reliable alternative to traditional health insurance that meets the needs of today’s families and individuals.

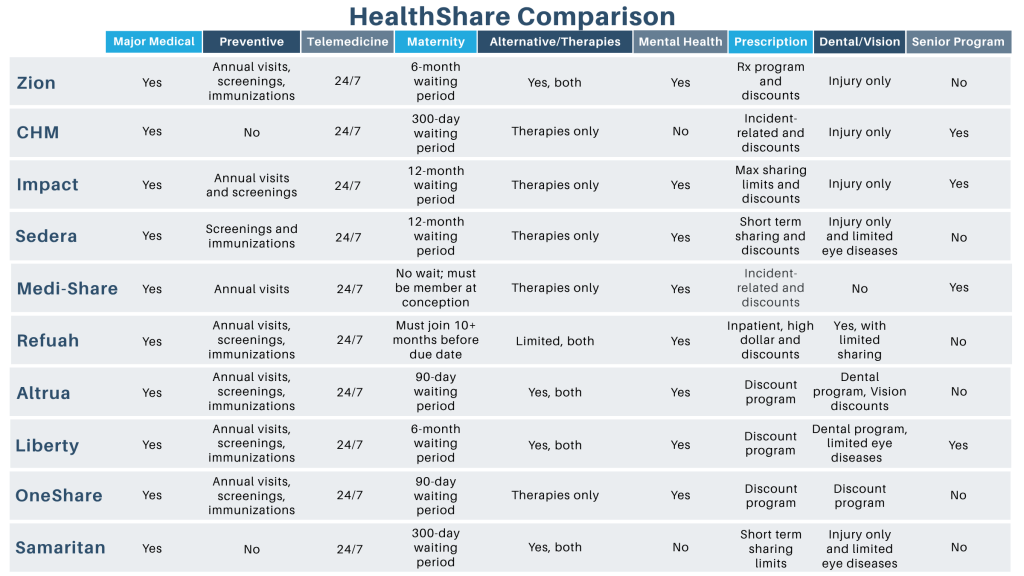

Explore the top 10 HealthShare plans for 2026, compare features and services, and see our top plan picks:

Top 10 HealthShare Plans in 2026

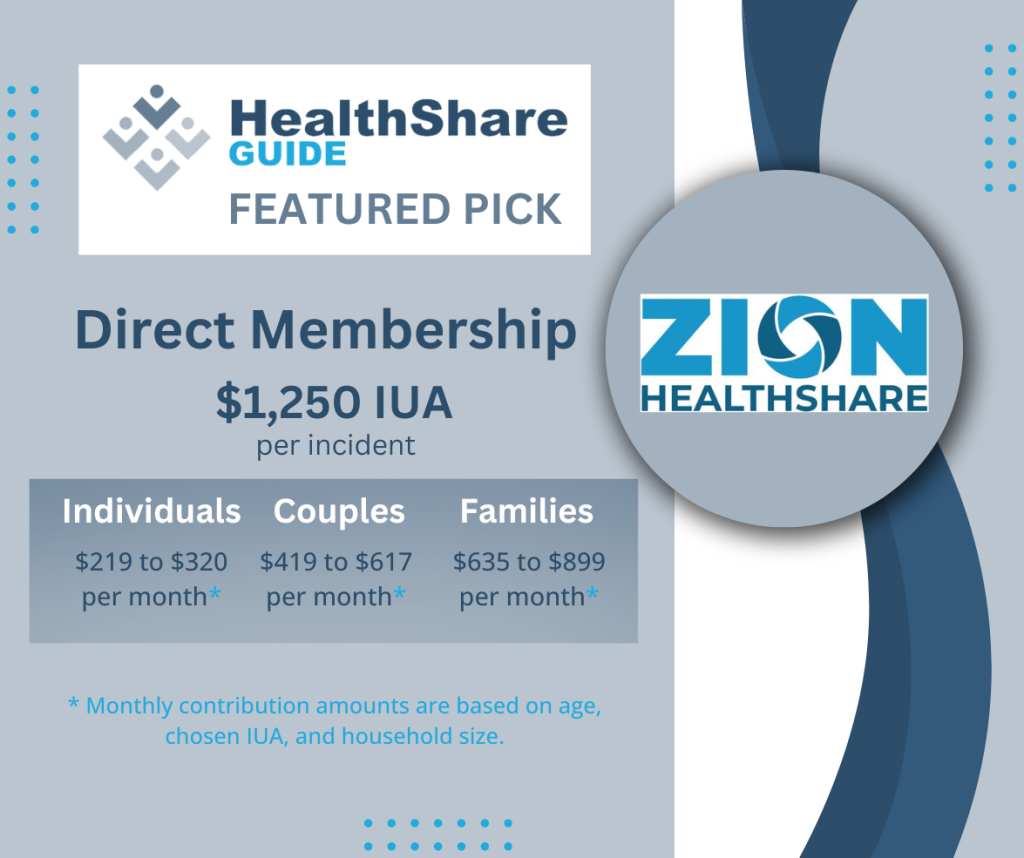

#1 Zion HealthShare

Why it stands out:

- Low cost, high value

- Fastest medical request processing time of 3 to 5 days

- Highly rated customer service and transparency

- Flexible plan designs

Key Features:

- Members choose an Initial Unshareable Amount (IUA) of $1,250, $2,500, or $5,000. Household out-of-pocket max: three IUAs in a rolling 12-month period.

- No religious requirements, no provider networks, and no annual or lifetime maximums.

- Integrated Direct Primary Care (DPC) providers offer convenient personalized care.

- Personalized company and organization options.

- Click to read more: Zion HealthShare

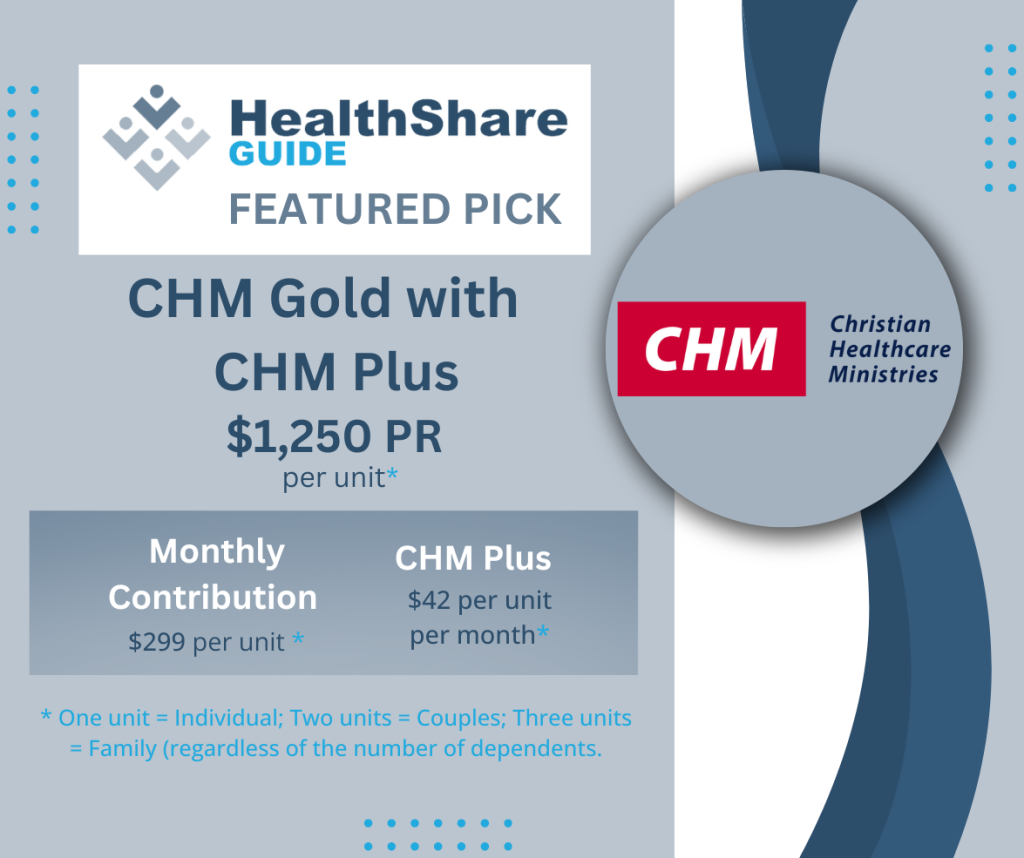

#2 Christian Healthcare Ministries (CHM)

Why it stands out:

- Affordable plans with optional CHM Plus program for additional sharing

- First and longest- serving HealthShare

- Transparent and clear guidelines

- Christian community supporting medical costs and spiritual needs

Key Features:

- Members choose an annual Personal Responsibility (PR) amount and must reach a minimum Qualifying Amount (QA). PR/QA options: $1,250 (Gold), $3,000 (Silver), or $6,000 (Bronze).

- CHM Plus (optional) provides an additional $100,000 per year up to $1 million per illness (Silver/Bronze); Unlimited cost sharing (Gold).

- Unit-based pricing represents participants within the membership. One unit = Individual; Two units = Couple; Three units = Family (regardless of the number of dependents).

- Specialized plans for members 65+ with Medicare Parts A and B, and for groups and organizations.

- Click to read more: Christian Healthcare Ministries

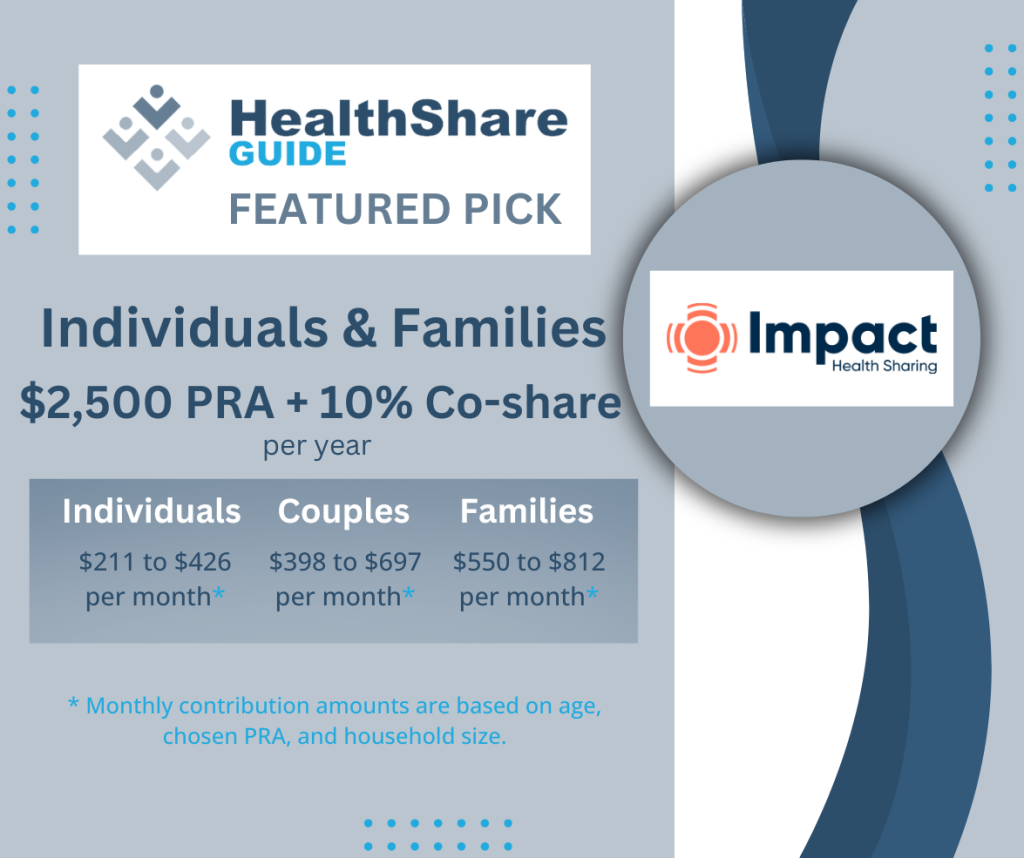

#3 Impact Health Sharing

Why it stands out:

- Wellness Rewards incentive for healthy living

- Annual wellness visit with $150 lab allowance

- Fast reimbursement time of 15-20 days

- Dental and vision discount program

Key Features:

- Members choose an annual Primary Responsibility Amount (PRA) of $2,500, $5,000, $7,500, or $10,000.

- After the PRA, members pay a 10% co-share up to $5,000 per household per year, with a $500,000 annual sharing limit per member.

- No religious requirements, no provider networks, and no lifetime maximum.

- Plan options for members 65+ with Medicare Parts A and B and for small groups.

- Click to read more: Impact Health Sharing

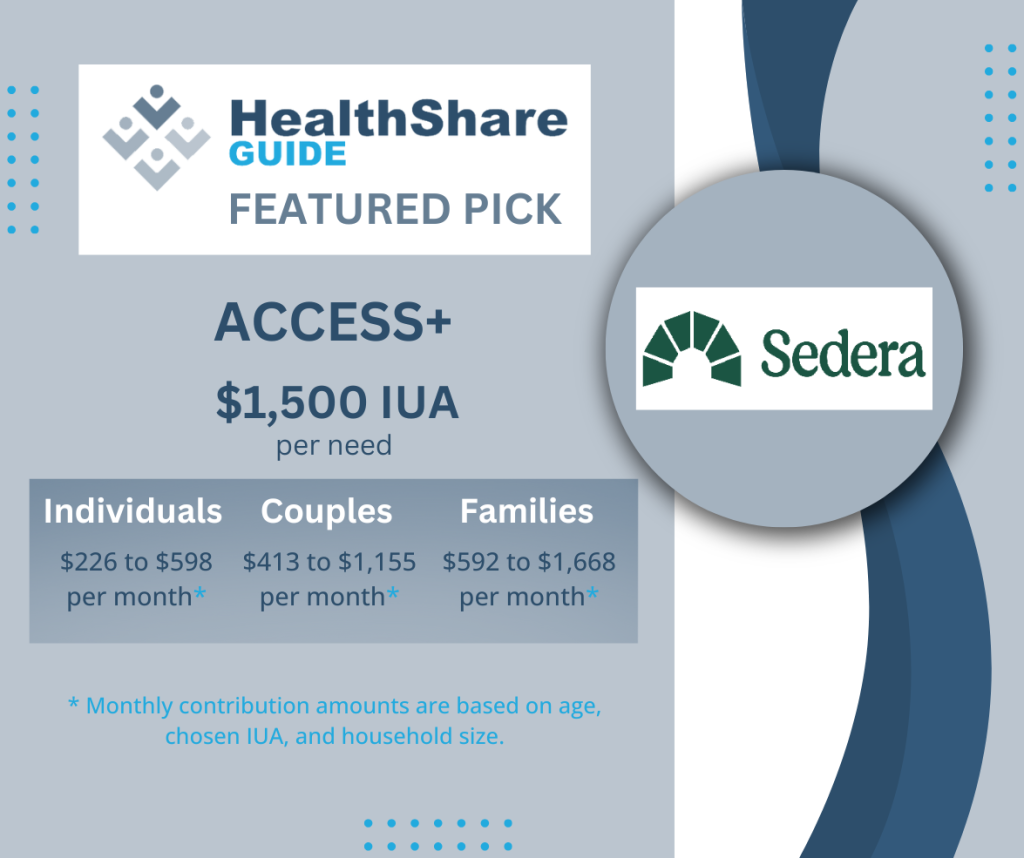

#4 Sedera

Why it stands out:

- Strong member support services

- Flexible plan levels

- Quick processing time of 14 to 60 days

- Pre-existing conditions fully covered after 36 months of membership

Key Features:

- Members choose an Initial Unshareable Amount (IUA) of $500, $1,000, $1,500, $2,500, or $5,000. Household out-of-pocket max: three IUAs in the 12-month membership year.

- No religious requirements, no provider networks, and no annual or lifetime maximums.

- Expert Second Opinion (ESO) is included that connects members with specialists to ensure they receive up-to-date and effective medical treatment.

- Team membership options available with specific team guidelines.

- Click to read more: Sedera

#5 Samaritan Ministries

Why it stands out:

- Direct member-to-member sharing

- Simple cost structure

- Medical tourism encouraged

- Christian, faith-based community with spiritual support through prayer requests and notes of encouragement

Key Features:

- Members choose from two membership levels (Classic and Basic) with an Initial Unshareable Amount (IUA) of $1,000 or $2,000 and per-need sharing limits of $247,500 to $250,000. A 10% co-share applies to the Basic program after the IUA, up to $2,500.

- No provider networks, and no annual or lifetime maximums.

- Dedicated options for members 65+ with Medicare Parts A and B and for groups and teams.

- Certain religions are excluded (see Samaritan guidelines).

- Click to read more: Samaritan Ministries

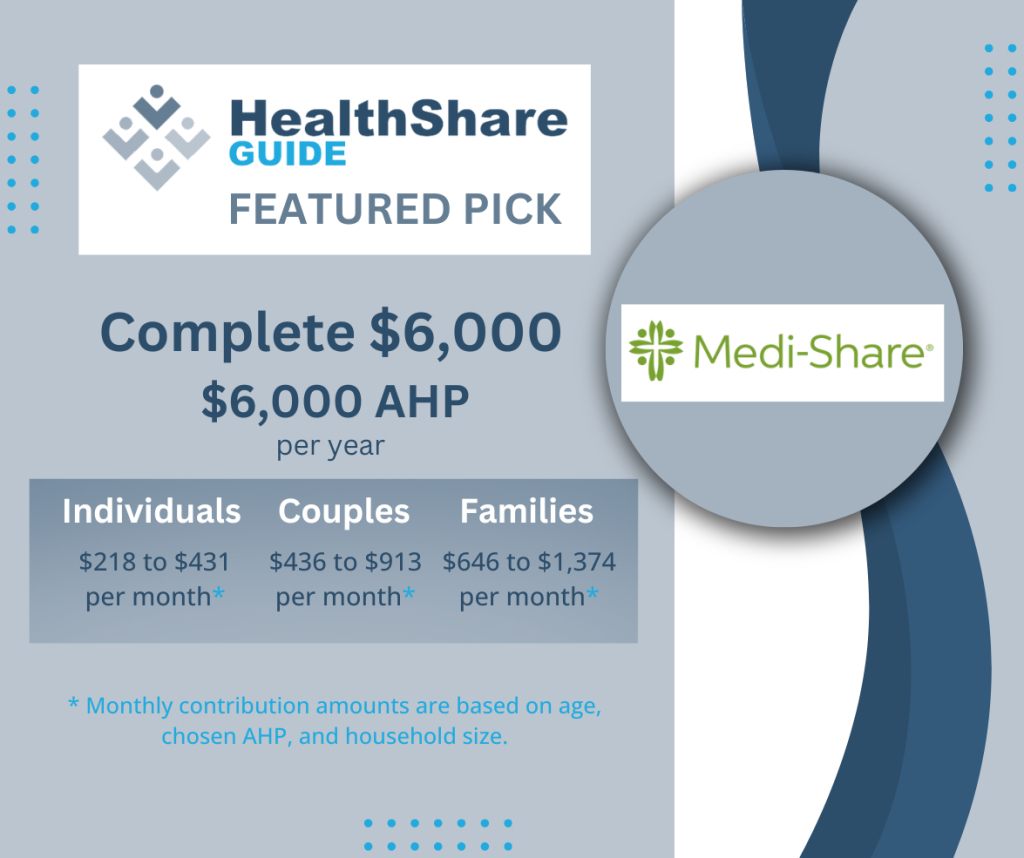

#6 Medi-Share

Why it stands out:

- Long track record as one of the oldest HealthShares

- Member voted guidelines

- Health incentive program for reduced monthly contributions

- Christian community guided by biblical principles

Key Features:

- Members choose an Annual Household Portion (AHP) of $3,000, $6,000, $9,000, or $12,000 with no annual or lifetime maximum.

- Provider fees apply per office, hospital, or telemedicine visit.

- Preferred Provider Organization (PPO) network through PHCS helps lower out-of-pocket costs.

- Plans for members 65+ with Medicare Parts A and B, with age-based pricing.

- Click to read more: Medi-Share

#7 United Refuah HealthShare

Why it stands out:

- Straightforward program structure

- Emphasis on wellness

- Assistance with health management

- Jewish community that shares Torah-based beliefs and lives a Jewish lifestyle

Key Features:

- Membership options for singles, couples, and families, with set pricing that does not vary by age.

- After the Annual PreShare Amount (APA), members pay a 20% co-share until the annual maximum is reached, after which expenses are shared at 100% up to $1 million per incident.

- No provider network restrictions and no lifetime maximum.

- Click to read more: United Refuah HealthShare

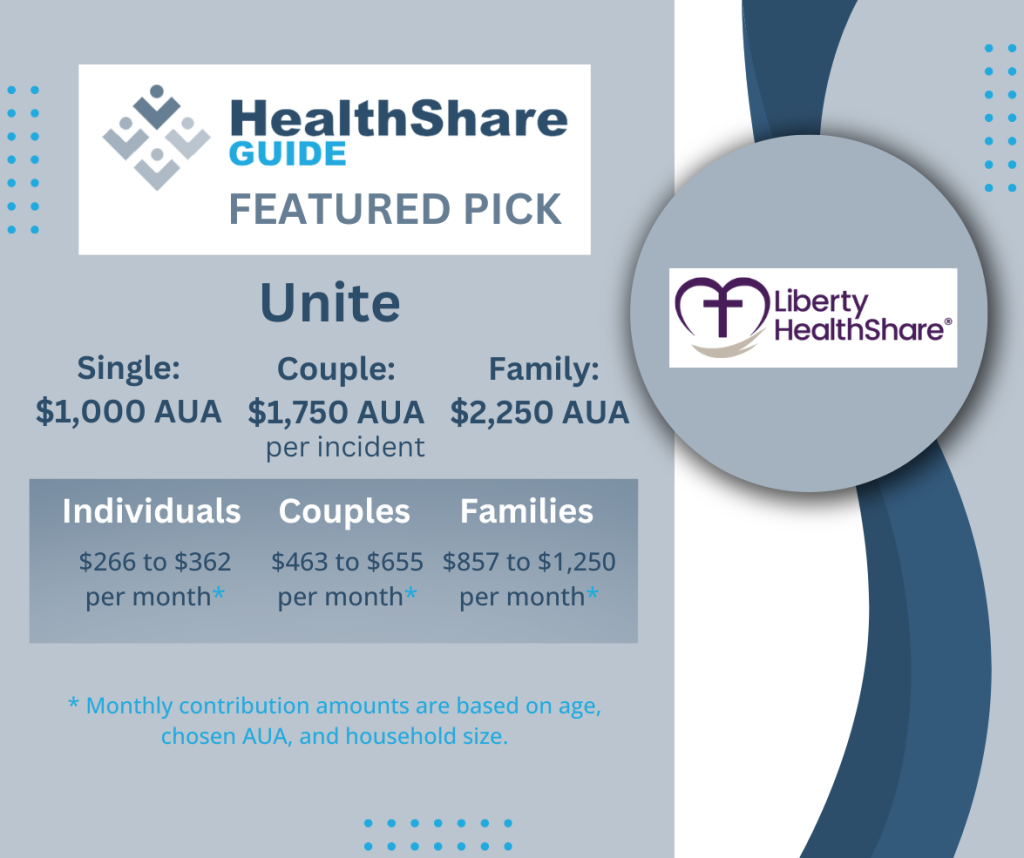

#8 Liberty HealthShare

Why it stands out:

- True dental sharing program, with a $2,000 annual limit per member

- Specific plans for young single adults, couples without children

- Non-denominational Christian community

Key Features:

- Members choose an Annual Unshared Amount (AUA) ranging from $1,000 to $20,000, with sharing limits from $50,000 to $1 million, depending on the program.

- Using PHCS provider network can reduce risk of balance-billing, though members can choose any provider.

- Plan options for members 65+ with Medicare Parts A and B.

- Click to read more: Liberty HealthShare

#9 Altrua HealthShare

Why it stands out:

- First to offer true dental sharing, with three membership options

- 30-day trial period

- Six pooled office visits per member (unused visits can be shared with other members of the same household)

- Non-denominational Christian community

Key Features:

- Members choose from four tiers, each with two Member Responsibility Amounts (MRAs): 1st MRA is from $500 to $7,500; 2nd MRA is 25% of the next $10,000, up to $2,500. Ruby memberships do not have a 2nd MRA.

- No provider networks.

- Annual and lifetime limits vary by membership program.

- Click to read more: Altrua HealthShare

#10 OneShare Health

Why it stands out:

- Rapid processing time of 14-21 days

- AI-powered mental wellness tools and peer support

- Next day activation

Key Features:

- Members choose an Individual Sharing Amount (ISA) of $5,000, $7,500, or $10,000, with per incident sharing limits of $150,000, $250,000, or $500,000 and lifetime limits of $300,000, $500,000, or $1,000,000, depending on the program.

- Using the First Health provider network helps reduce costs, though members can choose any provider.

- The WellCard Savings program offers discounts on additional services, including dental, vision, hearing, and more.

- Click to read more: OneShare Health

The HealthShare plans recognized in this guide stand out for a balanced mix of affordability, benefit options, and overall value. As 2026 brings new challenges and opportunities in healthcare, understanding plan details is key to finding the best fit for members.

Have experience with one of these HealthShare plans? Please share a review to help others make informed choices as they explore their plan options.

Click here to visit HealthShare Guide to leave a review or read what others are saying.