The 2026 HealthShare Guide

The HealthShare Advantage

Across the country, over a million people have turned to HealthShares as an alternative to traditional health insurance, and those numbers keep rising. These community-driven programs offer individuals, families, and businesses relief from the worry and frustration that often come with managing healthcare. With lower overall costs, greater flexibility, and a focus on transparency, they give members more control over their medical expenses and foster a strong sense of trust and community.

This guide was created to help individuals, families, and businesses compare leading HealthShare options for 2026. Discover what sets different HealthShares apart, understand important financial and community factors, and learn how to find the best fit for individual, family, or business needs.

Breaking Down HealthShares

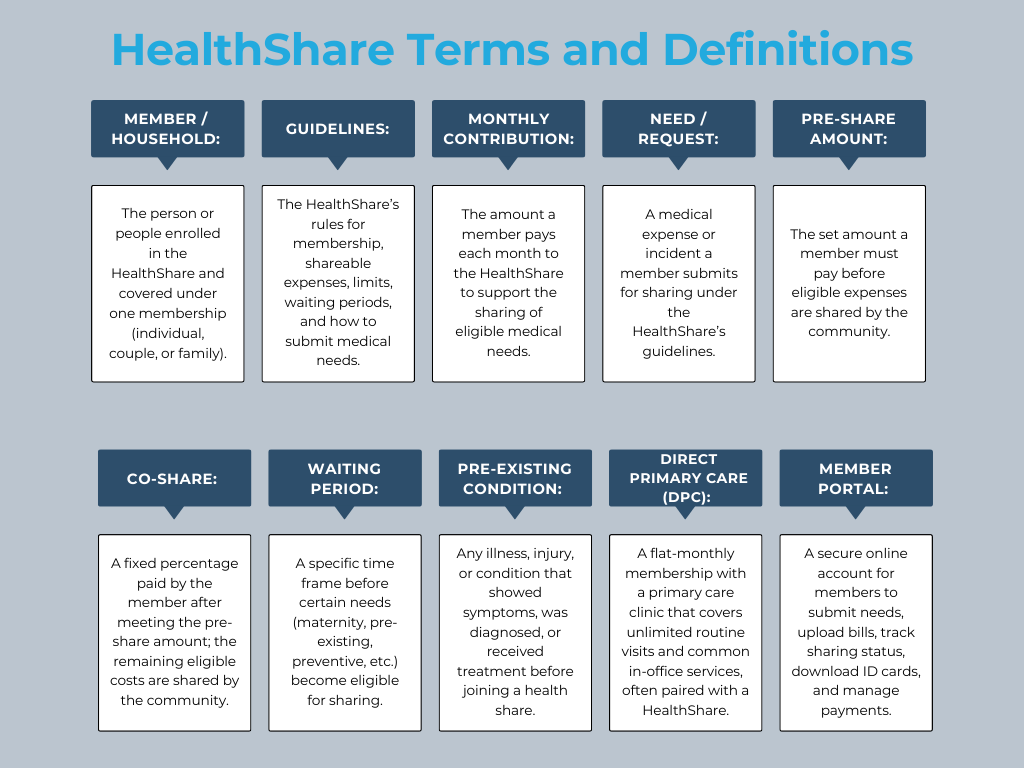

A HealthShare is a community of members who come together based on shared beliefs, values, or principles to support one another by sharing the cost of eligible medical expenses. Each HealthShare has its own set of guidelines that members agree to follow, outlining what types of needs can be shared and how the program is maintained. While primarily designed to help with unexpected injuries or illnesses, HealthShares also offer additional services for other types of healthcare expenses.

A HealthShare works by bringing members together to share medical expenses. Each member contributes a set monthly amount into a shared fund, which is then used to help with one another’s eligible medical expenses.

When a member submits a medical need or request, they first pay an initial pre-share amount (similar to a deductible). Once that portion is met, the remaining approved expenses are shared through the community’s pooled contributions, based on the HealthShare’s specific guidelines.

HealthShares are not insurance. They operate under a completely different structure. They are not regulated like insurance companies and do not guarantee payment. Instead, they are voluntary programs where members contribute to support one another’s medical needs, guided by clear expectations and agreed-upon principles.

Because sharing is not guaranteed, it’s important to research and select a well-established HealthShare with a strong track record of serving members and honoring eligible needs with transparency and integrity.

This structure allows members to benefit from a like-minded community and lower healthcare costs, without sacrificing access to quality care.

Each HealthShare handles medical needs or requests differently. Key elements to review include the initial personal responsibility or pre-share amount, co-sharing percentages (if applicable), annual or lifetime sharing caps, how major events like surgeries or hospitalizations are handled, and waiting periods or exclusions, including pre-existing conditions. It is also important to check provider access, how needs or requests are submitted, and typical reimbursement timelines. These factors are essential for comparing one program to another.

Each program has its own membership requirements. These often include lifestyle or faith-based commitments and participation rules that members must follow to remain eligible, such as submission timeframes for needs or requests, pre-notification for planned care, where required, on-time payment of the monthly contribution, and adherence to the required billing process. Reviewing these requirements in advance helps ensure the HealthShare aligns with a member’s values, health needs, and expectations.

To maximize the benefits of a HealthShare membership, it’s important to be financially prepared for how cost sharing works. Out-of-pocket costs may include the monthly contribution, pre-share amount, and co-share percentage (for some HealthShares). Members may also need to pay for care upfront before submitting for reimbursement or set aside funds for expenses that aren’t eligible for sharing.

Planning ahead and understanding whether payments are made directly to providers or submitted for reimbursement can help reduce surprises, making the healthcare experience smoother and more manageable.

Choosing the Right HealthShare: Individuals and Families

Healthcare Priorities

ℹ Zion HealthShare

Flexible and affordable options while maintaining services and care quality.

ℹ Christian Healthcare Ministries (CHM)

Low-cost tier options that align with various budgets.

ℹ United Refuah HealthShare

Flat rate pricing regardless of age.

ℹ Zion HealthShare

Low pre-share amount, no co-shares, no annual or lifetime limit.

ℹ Christian Healthcare Ministries (CHM)

Low per-incident responsibility, no co-shares, extended sharing limit option through CHM Plus.

ℹ United Refuah HealthShare

Slightly higher cost, but high member satisfaction, no co-shares, no lifetime limit.

ℹ Zion HealthShare

Free to choose any provider, care coordination support to help secure the best price and service.

ℹ Christian Healthcare Ministries (CHM)

Free to choose any provider, members are responsible for negotiating the best price.

ℹ Sedera (ACCESS+)

Free to choose any provider, members are responsible for negotiating the best price using an app or pricing tool.

ℹ Altrua HealthShare

Uses the PHCS network across all program levels, large network for more provider options.

ℹ OneShare Health

Uses the First Health network, though lower tier programs come with more sharing limitations and restrictions.

ℹ Medi-Share

Uses PHCS and First Health networks, provider access and requirements may vary depending on the program.

ℹ Zion HealthShare

Includes DPC directly as part of the membership through Primestin Care.

ℹ Sedera (ACCESS+)

Designed to work with DPC and encourages members to pair with a local DPC practice.

ℹ Medi-Share

Allows limited sharing of DPC fees but does not actively coordinate or integrate DPC care.

ℹ Zion HealthShare

Integrated virtual care through Primestin Care, consistent access to providers, care coordination, support built into their memberships.

ℹ Altrua HealthShare

Virtual care for non-emergency and general care through DialCare, available across all membership programs.

ℹ Impact Health Sharing

Virtual urgent care through the Member Center portal, access based on specific sharing guidelines.

ℹ United Refuah HealthShare

Comprehensive preventive care, including wellness exams, screenings, labs, and immunizations, no waiting periods and clear annual sharing limits.

ℹ Zion HealthShare

Annual wellness exam available immediately, screenings and immunizations eligible for sharing after a 6-month waiting period.

ℹ Impact Health Sharing

Annual wellness exam and a $150 preventive lab allowance, immunizations not shareable, includes a wellness incentive program called Wellness Rewards.

Family & Lifestyle Factors

Individuals & Couples

ℹ Zion HealthShare

Flexible for singles and couples, clear per-incident pre-share amount, adjustable options to fit budgets.

ℹ Christian Healthcare Ministries (CHM)

Per-incident pre-share amount with per-unit pricing (1 unit = individual, 2 units = couple) for predictable, age-neutral budgeting.

ℹ Medi-Share

One annual pre-share amount applies per household, whether for an individual or a couple.

Maternity

ℹ Zion HealthShare

Maternity is shareable after a 6-month waiting period, no maximum cost limits, dedicated maternity support team.

ℹ Christian Healthcare Ministries (CHM Gold)

Maternity eligible after 300 days of membership, broad sharing with optional CHM Plus for higher limits.

ℹ Liberty HealthShare (Essential, Connect, Unite)

Maternity is shareable after a 6 month waiting period, sharing cap of $125,000 per pregnancy.

Senior Programs (with Medicare Parts A and B)

ℹ Christian Healthcare Ministries (CHM SeniorShare)

For members 65+, unlimited sharing for eligible medical needs above $500, no Personal Responsibility (PR) amount.

ℹ Impact Health Sharing

For members 65+, no pre-existing condition limits, $1,000 Primary Responsibility Amount (PRA), eligible sharing up to $500,000.

ℹ Medi-Share (65+)

For members 65+, $500 Annual Household Portion (AHP), unlimited sharing for eligible costs.

ℹ Zion HealthShare

Allows tobacco use with a $50 increased monthly payment, no BMI restrictions, recreational sporting activities are generally eligible for sharing.

ℹ Sedera (ACCESS+)

Allows tobacco use with a $75 increased monthly payment and a $25,000 annual limit for tobacco-related conditions, no BMI restrictions, sports-related needs are not specifically addressed.

ℹ Impact Health Sharing

Allows tobacco use with a $50 increased monthly payment, has BMI-based eligibility rules and may add an additional monthly payment for high BMI, sports-related needs are not specifically addressed.

ℹ Zion HealthShare

Immediate sharing for high blood pressure, high cholesterol, and diabetes if controlled without recent hospitalization, 12-month phase-in for other pre-existing conditions.

ℹ Impact Health Sharing

Immediate sharing for high blood pressure and high cholesterol if controlled, 36-month phase-in for other pre-existing conditions with no signs, symptoms, treatment, or medication during that time.

ℹ Sedera (ACCESS+)

No exceptions for common conditions like high blood pressure, high cholesterol, or diabetes, all pre-existing conditions have a 12-month phase-in with some limitations on certain services.

ℹ Zion HealthShare

Nationwide access with no provider restrictions, worldwide emergency/urgent care eligible for sharing according to guidelines.

ℹ Christian Healthcare Ministries (CHM)

Nationwide access with no provider restrictions, international care eligible for sharing when translated to English and converted to USD.

ℹ Samaritan Ministries

Nationwide access with no provider restrictions, services abroad eligible for sharing with required documentation and subject to listed limitations.

Additional Services & Benefits

ℹ Zion HealthShare

Virtual counseling through Primestin Care as part of the membership, clinically appropriate number of sessions for acute needs, access to discounted prescriptions through Zion RxShare.

ℹ Impact Health Sharing

Virtual mental health available only through its approved teletherapy provider, subject to the PRA and co-share, members pay the session fee upfront and submit for sharing.

ℹ Sedera (ACCESS+)

Shares counseling, therapy, and psychiatric care costs up to $750 per needs case, $750 maximum per membership year.

ℹ Zion HealthShare

Shares prescriptions related to eligible medical needs, Zion RxShare at no extra cost for all Direct members, discounts on generics, brand-name, and specialty drugs.

ℹ Medi-Share

Shares prescriptions for six months from diagnosis for new, non-pre-existing conditions, access to a discount prescription program for other medications.

ℹ Sedera (ACCESS+)

Shares prescriptions as part of an eligible need for up to 120 days from diagnosis, members can then use a discount program for ongoing medication costs.

ℹ Medi-Share

Health Incentive Discount: Members who meet annual health standards receive a reduced monthly contribution for maintaining healthy habits, eligibility is reviewed yearly to encourage ongoing wellness.

ℹ Impact Health Sharing

Wellness Rewards: Members can earn credits toward their monthly contribution by participating in approved wellness activities, such as fitness programs or nutrition counseling.

ℹ Altrua HealthShare

SmileShare: Shares a broad range of preventive, restorative, and orthodontic dental services as part of the program, no third-party discount vendor.

ℹ Liberty HealthShare

Liberty Dental: Shares a wide range of preventive, basic, and major dental services directly through the program, no third-party discount vendor.

ℹ Impact Health Sharing

Careington Dental Savings: Access to a dental discount network, reduced rates on preventive and restorative services, such as cleanings, exams, fillings, and extractions./p>

ℹ Solidarity HealthShare

Vision Care: Offers a $50 eye exam, 15% off contact lens exams, special pricing on glasses and sunglasses, unlimited use throughout the year, exclusive member extras through the VSP network, no listed state restrictions.

ℹ Impact Health Sharing

Vision Savings Pass: Offers a $50 eye exam, 15% off contact lens exams, special pricing on glasses and sunglasses, unlimited use throughout the year, exclusive member extras through the VSP network, not available in Vermont or Washington.

ℹ OneShare Health

WellCard Savings: Offers up to 50% on lenses, frames, and other vision needs, 15% off laser vision correction, not available in Alaska, Washington, Montana, and Massachusetts.

Community Approach

ℹ Zion HealthShare

No religious requirement, members must follow the Principles of Membership and abide by the community’s guidelines.ℹ Sedera

No religious requirement, fosters a community built on ethical principles, personal responsibility, and healthy living.ℹ Christian Healthcare Ministries (CHM)

Agree to their Statement of Beliefs and live according to the teachings of the Holy Bible, must attend group worship regularly, abstain from tobacco and illegal drugs, follow Biblical standards on marriage and sexual conduct.

ℹ United Refuah HealthShare

For those Jewish by birth or Orthodox conversion approved by the rabbinical board, follow Torah-based beliefs, live a Jewish lifestyle, avoid intermarriage and same-gender relationships, abstain from tobacco, recreational drugs, substance abuse, and harmful behaviors.

ℹ Samaritan Ministries

Agree to their Statement of Faith based on Biblical principles, attend a Christian church regularly, live according to Biblical teachings, refrain from tobacco, illegal drugs, and sexual activity outside traditional marriage, some religions are restricted.

ℹ Zion HealthShare

Publishes detailed monthly and annual reports showing total medical needs shared, membership growth, and administrative costs, open access to guidelines and updates, strong member praise for clarity and honesty.

ℹ Impact Health Sharing

Clear, accessible financial summaries and guidelines, open communication about how member contributions are used, straightforward explanations of sharing processes.

ℹ Christian Healthcare Ministies (CHM)

Publicly releases IRS Form 990s showing a high percentage of contributions going toward member medical needs, transparent cost breakdowns and well-defined membership tier guidelines.

Member Support & Experience

ℹ Zion HealthShare

Medical Advocacy Team helps find affordable providers, secure self-pay discounts, arrange pre-payments, and coordinate surgeries, known for responsive communication and fast reimbursement.

ℹ Christian Healthcare Ministries (CHM)

Member Services Team assists with major medical needs, connects members to providers, and guides treatment and billing, dependable for surgeries, hospital stays, and extended care.

ℹ Medi-Share

Case managers guide members through major medical events, secure fair pricing, review bills, and coordinate care through their nationwide PHCS network.

ℹ Zion HealthShare

Multiple enrollment options (online, by phone, or virtual meeting), quick approvals, clear welcome packet, immediate access to the member portal, direct outreach from the Medical Advocacy Team to help new members understand benefits and start using services right away.

ℹ Impact Health Sharing

Simple application process with fast approvals, digital welcome materials walk members through submitting needs and contacting support, easy to begin using the program immediately.

ℹ Christian Healthcare Ministries (CHM)

Easy membership application, clear instructions, new members receive detailed welcome packet and step-by-step guidance for submitting medical needs, understanding tier benefits, and accessing support to start using their membership.

ℹ Zion HealthShare

Clear guidelines, user-friendly website, regular member updates, multiple educational formats (PDFs, videos, FAQs).ℹ Christian Healthcare Ministries (CHM)

Printed and digital materials, straightforward step-by-step instructions for submitting needs, detailed explanations of each membership tier.ℹ Impact Health Sharing

Organized member portal with topic-specific guidance, video tutorials, welcome guide, webinars, updated guideline summaries to keep members informed.Final Reflection

After reviewing the checklist, highlight the factors that align most with individual or family preferences and priorities. This helps narrow down options and make more meaningful comparisons when choosing a HealthShare.

Consider ranking options based on overall fit with:

- Individual or family needs

- Financial situation

- Payment or reimbursement process

What Employees Look for in Employer Benefits

1) Balance between monthly payments and out-of-pocket costs

People want predictable costs. Clear choices that trade a higher monthly amount for lower costs at the time of care.

2) Access to care: in-person, virtual, or both

Employees expect easy ways to see a clinician. Virtual care for speed and convenience, plus simple options for in-person visits when a hands-on exam, labs, or procedures are needed.

3) Freedom to choose providers

Being able to see a preferred doctor matters. Open choice or wide access, paired with tools that show fair prices, reduces friction and surprise bills.

4) Support for dependents and family members

Household-friendly options are a must. Simple ways to add a spouse or children, clear costs for each, and straightforward rules for eligibility.

5) Prescription savings, mental health, and wellness

Employees value help with everyday needs. Discounted medications, access to counseling, and practical wellness resources make the benefit feel useful all year.

6) Clear communication and education

Plain-language guides, quick-start checklists, and responsive support builds trust. Employees should know how to use their benefits on day one and where to get help when questions come up.

Choosing the Right HealthShare: Businesses and Organizations

Employer Priorities

ℹ Zion HealthShare (Essential)

The employer may pay none, part, or all of the cost, employees can pay via payroll deduction or direct payment, minimum participation is just two memberships.

ℹ Sedera (SELECT+)

The employer receives one monthly invoice for all enrolled members, employee contributions can be deducted through payroll and remitted to the HealthShare.

ℹ Christian Healthcare Ministries (CHM Groups and Organizations)

One monthly group invoice with employer-arranged contributions, members choose a tier that fits their budget.

ℹ Zion HealthShare (Essential)

Membership is not tied to employment status, easy to enroll W-2 and 1099 workers across locations.

ℹ Sedera (SELECT+)

Built for mixed workforces, accommodates remote and multi-site teams with clear eligibility rules.

ℹ Christian Healthcare Ministries (CHM Groups and Organizations)

Works for churches, nonprofits, and businesses, accepts varied worker types and locations. Religious requirements for each employee must be met.

ℹ Zion HealthShare (Essential)

Scales from small businesses to larger organizations, add members anytime with straightforward roster management.

ℹ Sedera (SELECT+)

Works for teams of any size, mix and match options support expansion.

ℹ Christian Healthcare Ministries (CHM Groups and Organizations)

Fits for any size group or organization, tier choices adapt to accommodate growth or budget changes.

ℹ Zion HealthShare (Essential)

Fast online enrollment with optional virtual sign-up meetings, clear welcome materials and immediate portal access, dedicated business support for managing enrollments and account changes.

ℹ Sedera (SELECT+)

Streamlined online team enrollment, employer portal to manage members and payments, responsive support for day-to-day admin needs.

ℹ Christian Healthcare Ministries (CHM Groups and Organizations)

Straightforward group application, organized welcome packet and easy account management with group billing, access to a group support team for ongoing admin questions.

Final Relection

After reviewing the checklist, highlight the features that align with company values, employee needs, and budget. This helps narrow down the HealthShares that provide the best overall fit.

Consider ranking options based on:

- HealthShare meets both business and employee priorities

- Costs are sustainable and aligned with company goals

- Administrative process is simple for both HR and team members

- Long-term solution

Disclaimer:

The top HealthShare selections in each category were determined using a combination of member reviews, official program guidelines, and insights from reputable HealthShare platforms and resources. While every effort was made to ensure accuracy, readers are encouraged to review each HealthShare’s current guidelines to confirm details before enrolling.

We'd Love to Hear from You

Have experience with a HealthShare? Your voice matters.

Leave a review to help others make informed decisions—just select your HealthShare from the dropdown at the top of the page and scroll to the bottom to submit your feedback.

Click to share your experience:

If you’re still deciding, take a moment to read through reviews from other members. Their insights can be incredibly valuable as you explore your options.

Thank you for being part of the HealthShare Guide community!