When considering a HealthShare, prospective members tend to focus on monthly contributions, aiming ultimately to reduce their monthly expenditures. However, understanding the concept of member responsibility, or what a member is required to pay up front for medical expenses, is critical before committing to a HealthShare. Only after the member responsibility amount has been met will the sharing community start to contribute.

What is HealthShare member responsibility?

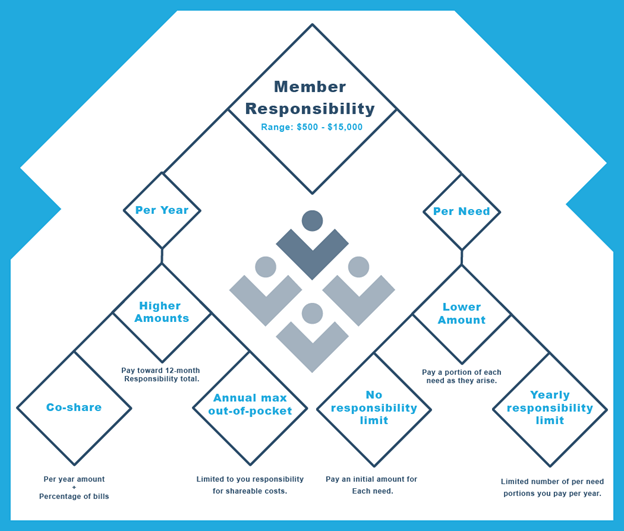

Member responsibility, which can range anywhere from $500–$15,000, may appear under different labels, but they all mean essentially the same thing. To understand the extent of a potential member’s personal responsibility, they must examine the specific terms and conditions of their particular HealthShare.

Common alternative terms for “member responsibility” include “Annual Unshared Amount” (AUA), “Annual Household Portion” (AHP), “Initial Unshareable Amount” (IUA), “Member Responsibility Shared Amount” (MRSA), “Personal Responsibility Amount Yearly” (PRAY), and more straightforward terms like “Personal Responsibility” (PR) and “Unshared Amount” (UA).

While these terms may initially create some confusion, they all relate to personal responsibility. Each term provides clues to help potential members understand their obligations when faced with healthcare costs.

Per year or per need responsibility

When evaluating personal responsibility amounts in a HealthShare, it is essential to understand if the responsibility is annual or per need/incident. If the term includes “annual,” then it will be an amount that is figured on a yearly basis, whether it’s a calendar year or a membership year. Other terms may simply indicate an “unshared” or “unshareable” amount without specifying “annual.” In these cases, the personal responsibility may still be for a 12-month period. If “annual” is not in the term, it may suggest a per-need or per-incident amount. Lower personal responsibility options, such as $500, likely indicate a per-need or per-incident responsibility amount.

Co-shares and maximum unshareable amounts

Two additional terms to consider are “co-share” and “maximum unshareable amount.” Co-share refers to a membership structure wherein the HealthShare will not share in 100% of expenses after the member responsibility is met. Instead, the sharing community only shares a portion of the eligible expenses. For example, a member might have an annual unshared amount of $2,000, and after reaching that limit, they pay for 20% of their medical expenses while the sharing community shares the remaining 80%.

HealthShares with this arrangement will set a maximum amount that a member is responsible for in a year. Using the previous example, the annual maximum personal responsibility might be around $5,000.

Reduced sharing and maximum member responsibility

Meeting a member responsibility amount does not necessarily guarantee that the member will have no further bills to pay. Depending on the HealthShare, some expenses may be shared at 100% after the initial responsibility amount, while other expenses may only be shared at 60%. Each HealthShare is set up differently and it may take some work to learn all the details.

To minimize additional costs, consider a HealthShare with a limit on member responsibility, such as an annual out-of-pocket maximum or a maximum number of per-need member responsibility amounts. For example, Zion HealthShare limits responsibility to three Initial Unshareable Amounts (IUA) in a 12-month period. Samaritan Ministries sets a maximum unshared amount of $2,500–$10,000 for members on the Samaritan Given program.

Potential additional expenses

Monthly contribution and member responsibility amounts alone do not indicate total out-of-pocket expenses. Depending on individual circumstances, additional medical expenses may not be shared by the HealthShare community and typically do not count toward the member responsibility amount. When reading through member guidelines and program descriptions, potential members should look for sharing outlines that are best suited to their needs.

A determining factor

When selecting a HealthShare, potential members should consider not only monthly contributions, but also member responsibilities, maximum unshareable amounts, co-share options, and other responsibility amounts. Ultimately, member responsibility may be the deciding factor in HealthShare choice. Careful research and a thorough understanding of the program can help ensure the chosen HealthShare aligns with individual needs and budgets.