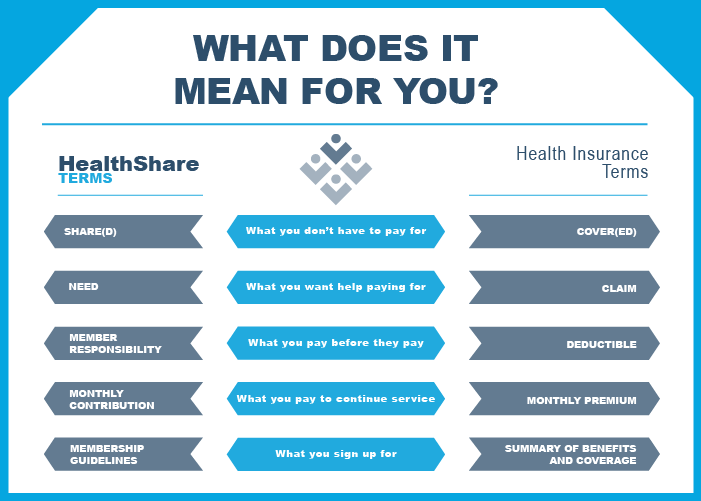

When reviewing HealthShare websites or member guidelines, members might notice that HealthShares use words like “need” and “share” in unique ways. These unfamiliar terms might cause some confusion—particularly when compared to more well-known terms used by health insurance companies.

Why don’t HealthShares use the same terms as insurance companies?

Since both are methods to help pay for medical bills, it might be natural to assume that the common insurance terminology should apply to HealthShares. Unfortunately, the situation is more complex than that.

HealthShares are not bound by the the same legal obligations as traditional insurance, and using common terminology would serve only to create confusion between the two. Any reputable HealthShare will make it clear that they are not an insurance company—using a different vocabulary is a fundamental way to help draw that distinction.

A closer look at common health insurance terms reveals where HealthShare vocabulary overlaps with or diverges from comparable concepts.

Cover vs. Share

The insurance term “cover” or “coverage” is often used in casual conversation about HealthShares. This usage is understandable due to familiarity with the word “Cover.” But, when discussing HealthShares, this word can be misleading.

Most HealthShares make it clear that they are not insurance and are not legally required to cover anything. Instead, a HealthShare facilitates sharing among members according to a set of agreed-upon standards. For this reason, HealthShares utilize the term “share” to describe the handling of member medical costs.

Nevertheless, “cover” and “share” have the same idea: the portion of healthcare costs paid for by the group—not the individual. In an insurance plan, the item is covered by the selected plan provider, while in a HealthShare, the cost may be shared by the membership community.

Claim vs. Need

Insurance companies use the word “claim” to describe a request for bill coverage. A claim implies a right to coverage, and the company must pay for it if the request fits the summary of benefits and coverage.

HealthShares use the term “need” to describe an illness or injury resulting in expenses requiring assistance. A need implies a request for help, without obligating the company to provide it. However, if a need falls within the member guidelines, and membership requirements are met the need will likely be addressed.

Related expressions include “submitting a claim” and “submitting a need” (or “need request”). Submitting a claim on an insurance policy may happen automatically, done by the provider after collecting insurance information. With a need, documentation is typically submitted by the individual.

With HealthShares, some providers may forward bills directly to the cost-sharing organization, or individuals may pay up front and submit their need as a reimbursement request. In either case, the process with a HealthShare tends to involve more participation than with a typical insurance claim.

Deductible vs. Member Responsibility

Whether opting for traditional health insurance or joining a HealthShare, a certain dollar amount must be paid before the organization contributes to bills. For health insurance, this amount is called a deductible; for a HealthShare, it is called member responsibility.

A HealthShare may have a specific term for member responsibility. Member responsibility may be an annual or per-need amount, whereas a standard health insurance deductible is an annual amount.

A typical health insurance policy will have an “out-of-pocket maximum,” a limit on how much the insured will pay toward their medical care in a year. Likewise, a HealthShare may use the same term or something similar like “maximum member responsibility.” Since HealthShares have specific guidelines about what is and is not eligible for sharing, an out-of-pocket maximum is not a strict limit on medical care spending. Instead, it is a limit on spending for shareable expenses that qualify as a need.

What is eligible for cost sharing and what is eligible for insurance coverage may differ significantly. Nonetheless, out-of-pocket maximum refers to a maximum amount paid in a 12-month period on eligible items.

Another minor point to look for in relation to member responsibility and out-of-pocket maximums is whether or not a HealthShare uses a coshare system. A coshare is similar to the idea of an insurance copay and coinsurance. If a HealthShare has a coshare structure, an individual may be responsible for some kind of initial amount or visit fee plus a portion of each need.

Monthly Premium vs. Monthly Contribution

Both health insurance companies and HealthShares require regular payments. Insurance policies have a monthly premium, paid directly or deducted from a paycheck. To maintain HealthShare membership, a monthly contribution is submitted.

If a member decides to terminate their HealthShare membership, they can stop contributing anytime. Of course, if they do so, they will forfeit any membership privileges—like sharing medical bills with the community. With health insurance, a policyholder generally commits to a term of service, and thus commits to paying a monthly premium amount until the next enrollment period.

Summary of Benefits and Coverage vs. Membership Guidelines

Health insurance provides a summary of benefits and coverage, detailing what is and is not covered by a selected (or workplace-provided) plan. In the case of a HealthShare, the membership guidelines serve a similar purpose.

A HealthShare’s membership guidelines provide details about what is and is not eligible for sharing with the community. These guidelines also detail behavior that may be deemed unacceptable for members or behavior that, if resulting in a medical need, will not be considered for sharing.

HealthShare Guide is here to help

Relying on familiar terms like “coverage” and “claim” is natural. But, when individuals incorporate HealthShare membership into their healthcare strategy, understanding HealthShare-specific vocabulary becomes essential for grasping the differences between the two approaches.